Top page > Forest

Forests provide the services of producing substances that we use as wood and food, recharging water, preventing floods and sediment disaster in large storms, absorbing CO2 and mitigating climate change as well as providing habitats for diverse living creatures and sites for recreation and environmental education.

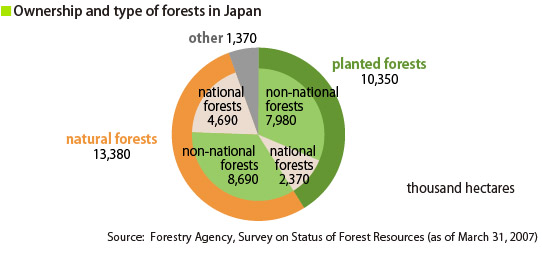

Forests cover two-thirds of Japan. Although forest coverage has not changed in over 40 years, decreased demand for domestic wood and lower timber prices, tree thinning and other forest management activities have been sabotaged, therefore depleting many planted forests. In planted forests that have not been adequately thinned or cut, the forests are too dense for roots to establish themselves deep in the soil and for sunlight to pass the leaves to the forest floor. This has inhibited underbrush growth, therefore making the soil vulnerable to snow, wind and typhoon-inflicted damages. This also depletes the biodiversity in the area. Of these planted forests which require appropriate management by human hands, 77 percent is non-national[1](figure below) and is managed under the will of their owners, with the exception of forest reserves which are subject to a mandatory management schedule. With forestry yielding little profit, new financial sources to fund forest improvement of planted forest, which are privately or publicly manage, need to be sought.

With the adoption of the Collective Decentralization Law in 2000 which enabled Japanese local governments to individually levy taxes for specific purposes, Kochi Prefecture formulated the Forest Environment Tax in 2003. Under the tax program, the prefecture maintains and restores the diverse functions of forests by directly improving them using the tax revenue, collected from the public, the people who are, in essence, the beneficiaries of the blessings provided by forests. From this perspective, the Forest Environment Tax can be regarded a similar example of payments for ecosystem services (PES). Kochi Prefecture's innovative example has been succeeded by other local governments, the number of which totals 30 prefectures and one city as of April 2009. The introduction of this new tax program has enabled local governments to securely implement their tree trimming-oriented forest improvement programs according to an established schedule.

his section will introduce three forest environment taxes: Kochi Prefecture's pioneering example, Tochigi Prefecture's program which discloses valuations of the tax's accomplishments and Kanagawa Prefecture's program which comprehensively addresses the conservation and restoration of water source environments instead of only forest environments.

[1] Non-national forests refer to those either privately-owned or owned by local governments.